Easy Money: Why Safe Investments Will Lose Money

I work with a lot of conservative investors. A lot of times they’ll come in and they’ll have a lot of money sitting in checking or savings, and believe it or not, even under their mattress. They’ll have cash just sitting there. I ask why, and they always say, “Well, I want my money to be safe. I don’t want to lose any money at all.” That sounds like a good strategy and you’re not losing money, right? You have a dollar under your mattress and you pull it back out, it’s still a dollar.

The problem is for a healthy economy, we need that thing called inflation. It has to happen. If we don’t have inflation then we have a bad economy. We’re always going to have it as long as your money is worth something. Inflation historically is 3%, so if you think about it, if you’re earning 0%, you’re actually losing 3%.

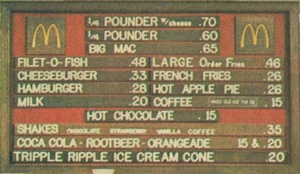

Let’s take a look at this menu from the 1970s from McDonald’s. You might notice that the brand is still the same, but the prices have changed. You see a Quarter Pounder for 70 cents. You see hot chocolate for 15 cents. When’s the last time that you walked in anywhere with three nickels and expected to buy something? It just doesn’t happen anymore. This is the sign of inflation.

You might say it’s crazy that things were that low, but if you ask anybody that was around in the 70’s and went to McDonald’s, the prices back then actually felt higher than they do today. Similarly, people were making $7,000 – $9,000 back in the 70’s and they weren’t feeling strapped because a new car was only $3,000 and now a new car is $30,000 or $40,000.

If you plan on being able to buy something in 20 or 30 or 40 years, and you want to be able to pay for that $13 Big Mac, or you want to be able to pay for that $100,000 Honda Civic, you have to be able to keep up with inflation in your investments. I’m not saying you have to take risks in your investments, but you should at least find something that’s at least close to the cost of living that’s going up every single year.

Securities and advisory services offered through Madison Avenue Securities, LLC, member FINRA SIPC, and a registered investment advisor. Madison Avenue Securities, and Don Anders are not affiliated companies.